FEATURED:

USEFUL:

KNOWLEDGE

BASE

HERE YOU WILL FIND A WEALTH OF INFORMATION, RESOURCES AND TOOLS TO HELP YOU NAVIGATE YOUR CRYPTO BUSINESS JOURNEY WITH CONFIDENCE.

OUR KNOWLEDGE BASE IS DESIGNED TO PROVIDE YOU WITH ALL NECESSARY MATERIALS TO HELP YOU MAKE INFORMED DECISIONS, SAVE MONEY AND ACHIEVE YOUR GOALS.

OUR KNOWLEDGE BASE IS DESIGNED TO PROVIDE YOU WITH ALL NECESSARY MATERIALS TO HELP YOU MAKE INFORMED DECISIONS, SAVE MONEY AND ACHIEVE YOUR GOALS.

MiCA ESSENTIALS

SWIFT SUMMARIES

YOUR COMPREHENSIVE RESOURCE FOR COMPREHENDING AND NAVIGATING THE MICA FRAMEWORK.

It's widely known that Liechtenstein, a crucial component of the European Crypto Valley alongside multiple Swiss cantons, has become an appealing jurisdiction for blockchain ventures and infrastructure projects of diverse scales.

Our guide serves as a comprehensive roadmap for entrepreneurs, investors, and businesses looking to understand how to initiate and operate a web3 business in Liechtenstein.

In-Depth Insights

It's a treasure trove of insights into the legal, regulatory, and market aspects shaping the industry in Liechtenstein.

Our guide serves as a comprehensive roadmap for entrepreneurs, investors, and businesses looking to understand how to initiate and operate a web3 business in Liechtenstein.

In-Depth Insights

- Market Overview: Discover the expansive use of blockchain in sectors such as finance, environmental conservation, private data computing, and more.

- Token Economy: Explore the prevalent use of tokens and NFTs within the jurisdiction.

- Blockchain and ESG: Uncover how blockchain intersects with Environmental, Social, and Governance objectives.

- Regulatory Landscape: Get detailed insights into Liechtenstein's pioneering Blockchain Act and its impact on licensing, regulations, and token-related services.

- Initiatives & Reviews: Learn about governmental initiatives and ongoing reviews fostering blockchain development.

- Tokenization: Dive into the requirements and processes for tokenization platforms.

- Smart Contracts: Explore the legal framework around smart contracts and their implementation as well as the cryptocurrency trading scenario and its regulation in Liechtenstein.

It's a treasure trove of insights into the legal, regulatory, and market aspects shaping the industry in Liechtenstein.

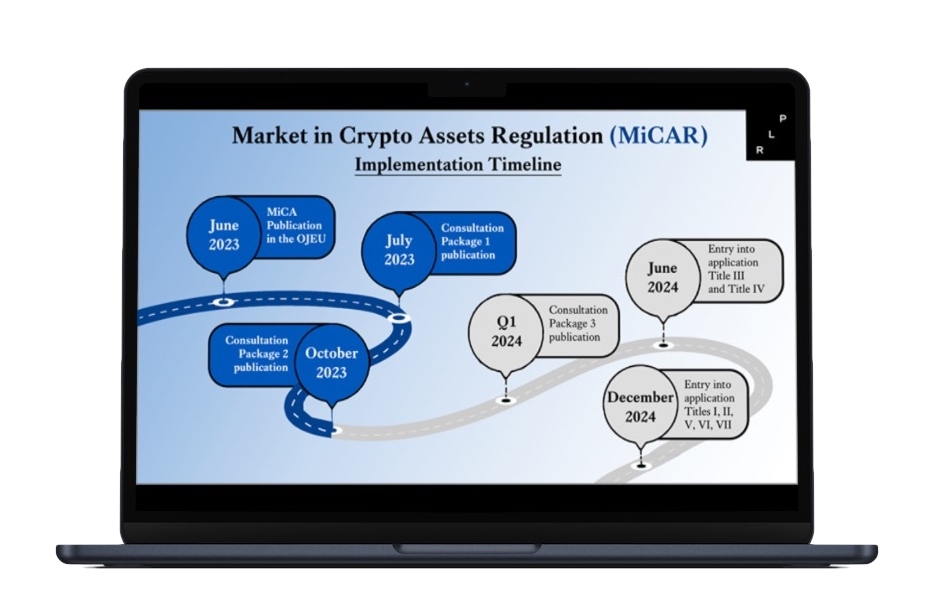

European Securities and Markets Authority (ESMA), which serves as the EU's financial markets regulator, has released its second consultation package related to the MiCA.

The documents published 05/10/2023 cover five key areas:

ESMA will compile a final report based on the feedback received and submit the draft technical standards to the European Commission for endorsement, no later than June 30, 2024.

The documents published 05/10/2023 cover five key areas:

- Sustainability indicators for distributed ledgers

- Disclosures of inside information

- Technical requirements for white papers

- Trade transparency measures

- Record-keeping and business continuity requirements for crypto-asset service providers

ESMA will compile a final report based on the feedback received and submit the draft technical standards to the European Commission for endorsement, no later than June 30, 2024.

PLEASE FEEL FREE TO CONTACT US VIA EMAIL TO RECEIVE A COMPREHENSIVE LIST OF OUR SERVICES OR TO SEEK LEGAL OR TAX ADVICE.