FEATURED:

USEFUL:

ACTIVE COMPANY

IN SWITZERLAND

COMMENCING A BUSINESS VENTURE IN SWITZERLAND DOES NOT ENTAIL A CUMBERSOME PROCESS, PARTICULARLY WHEN INVESTORS POSSESS THE REQUIRED CAPITAL FOR COMPANY REGISTRATION.

OUR TEAM OF EXPERIENCED LAWYERS IN SWITZERLAND IS AVAILABLE TO PROVIDE EXPERT ASSISTANCE IN THE REGISTRATION OF A SWISS BUSINESS, ENSURING A SEAMLESS PROCESS FOR OUR CLIENTS.

OUR TEAM OF EXPERIENCED LAWYERS IN SWITZERLAND IS AVAILABLE TO PROVIDE EXPERT ASSISTANCE IN THE REGISTRATION OF A SWISS BUSINESS, ENSURING A SEAMLESS PROCESS FOR OUR CLIENTS.

[ COMPANY SET-UP ]

FROM DETERMINING THE RIGHT TYPE OF COMPANY THE ESTABLISHMENT OF AN APPROPRIATE SHARE CAPITAL AND DEFINITION OF COMPANY'S OBJECTIVES,

OUR EXPERTS ARE COMMITTED TO PROVIDING COMPREHENSIVE SUPPORT TO ENSURE A SUCCESSFUL AND REWARDING BUSINESS VENTURE IN SWITZERLAND.

OUR EXPERTS ARE COMMITTED TO PROVIDING COMPREHENSIVE SUPPORT TO ENSURE A SUCCESSFUL AND REWARDING BUSINESS VENTURE IN SWITZERLAND.

- CHOICE OF A LEGAL FORM. THE MOST COMMON LEGAL FORMS FOR CRYPTO OR TOKENIZATION-RELATED BUSINESSES ARE GMBH (A LIMITED LIABILITY COMPANY) OR AG (A STOCK COMPANY).

- SHARE CAPITAL CONTRIBUTION IS 20K FOR A GMBH AND 100K FOR AN AG IN SWITZERLAND. CRYPTOCURRENCIES AND STABLECOINS ARE ALSO ACCEPTABLE FOR PAYMENT OF THE SHARE CAPITAL.

- AS PER SWISS LAW, EVERY COMPANY NEEDS TO HAVE A LOCAL DIRECTOR WHO IS RESPONSIBLE FOR THE DAY-TO-DAY OPERATIONS AND WHO MUST BE A RESIDENT OF

- YOU SHOULD ALSO ENGAGE AN ACCOUNTANT AND AN AUDITOR TO HANDLE THE COMPANY'S ADMINISTRATION. THE Y WILL ASSIST YOU WITH ACCOUNTING, BOOKKEEPING, AND TAX COMPLIANCE.

- FINALLY, WHAT WILL BE TIME-CONSUMING BUT CRUCIAL, YOU WILL NEED TO OPEN A BANK ACCOUNT TO RECEIVE PAYMENTS AND PAY EXPENSES.

SWITZERLAND

THE FOUNDATION PROCESS OF AN ACTIVE COMPANY DEMANDS CAREFUL ATTENTION TO EACH STAGE OF PREPARATION.

FROM DOCUMENT GATHERING TO BANK ACCOUNT OPENING, TREATING EACH STEP RESPONSIBLY AND DILIGENTLY IS CRUCIAL FOR SUCCESS.

FROM DOCUMENT GATHERING TO BANK ACCOUNT OPENING, TREATING EACH STEP RESPONSIBLY AND DILIGENTLY IS CRUCIAL FOR SUCCESS.

ACTION PLAN

& TIMELINE

& TIMELINE

[ THE PROCESS ]

OPENING A BANK ACCOUNT

FOR INITIAL CAPITAL

UP TO 2 MONTHS

FOR INITIAL CAPITAL

UP TO 2 MONTHS

PREPARATION

OF DOCUMENTS

1-2 WEEKS

OF DOCUMENTS

1-2 WEEKS

COMPANY REGISTRATION

PROCESS

UP TO 1 MONTH

PROCESS

UP TO 1 MONTH

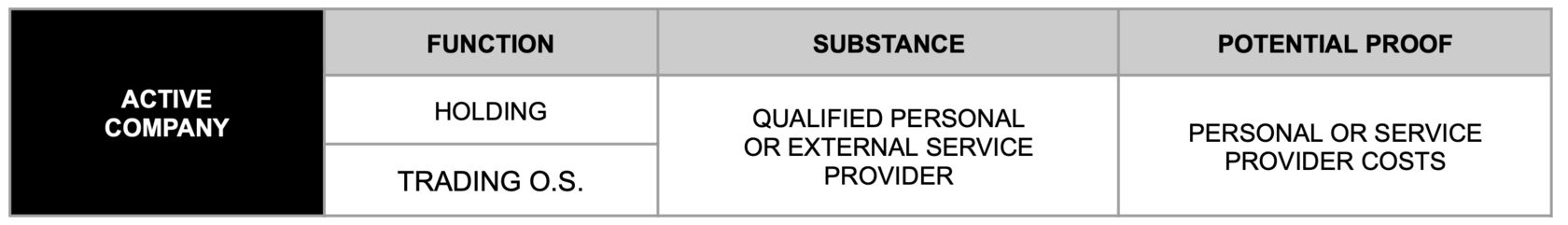

AN ACTIVE COMPANY NEEDS TO FULFIL LOCAL REQUIREMENTS FOR SUBSTANCE & PRESENCE

(THE RULES ARE TYPICAL FOR ALL EUROPEAN COUNTRIES)

(THE RULES ARE TYPICAL FOR ALL EUROPEAN COUNTRIES)

THE COST OF A LOCAL DIRECTOR IN SWITZERLAND CAN RANGE FROM 3 TO 10 THOUSAND SWISS FRANCS PER ANNUM. ACCOUNTING AND AUDITOR FEES ARE SIMILAR IN CHARGE, SO YOU CAN EXPECT TO PAY THE SAME AMOUNT FOR EACH SERVICE.

IT IS WORTH REITERATING THAT THESE COSTS ARE ONLY ESTIMATES AND CAN VARY BASED ON THE SPECIFIC ADVISORS YOU CHOOSE TO WORK WITH AND THE SCOPE OF WORK NEEDED.

IT IS WORTH REITERATING THAT THESE COSTS ARE ONLY ESTIMATES AND CAN VARY BASED ON THE SPECIFIC ADVISORS YOU CHOOSE TO WORK WITH AND THE SCOPE OF WORK NEEDED.

PRICING

[ THE COSTS ]

FROM 5,000 CHF

WE HAVE JUST WHAT YOU NEED TO KICK-START YOUR JOURNEY TOWARDS SUCCESSFUL INCORPORATION.

PLEASE FEEL FREE TO CONTACT US VIA EMAIL TO RECEIVE A COMPREHENSIVE LIST OF OUR SERVICES OR TO SEEK LEGAL OR TAX ADVICE.